The Economics of Biodiversity: The Dasgupta Review

Professor Sir Partha Dasgupta FRS FBA

Frank Ramsey Professor Emeritus of Economics, Faculty of Economics, University of Cambridge

This is an expanded version of a speech delivered by Professor Sir Partha Dasgupta at a virtual event hosted by the Royal Society on Tuesday 2 February 2021. The occasion marked the launch of his independent, global Review on the Economics of Biodiversity, commissioned by HM Treasury. The launch was chaired by the Society's Past President, Sir Venki Ramakrishnan.

Not so long ago, the economic questions requiring urgent attention could be studied by excluding Nature from formal economic reasoning. At the end of the Second World War, with absolute poverty endemic in much of Africa, Asia and Latin America, and with Europe in need of reconstruction, it made sense to focus on the accumulation of produced capital (roads, buildings, ports, machines) and human capital (health and education).

Unfortunately, the resulting macroeconomic models of growth and development so directed the way academic economists and economic policymakers collect and analyse data, forecast trajectories, design policy and conceive our economic possibilities, that we have over time come to imagine that we can bypass Nature in our economic lives. That belief has been strengthened by the fact that the average person today enjoys a far higher income, is less likely to be in absolute poverty, and lives significantly longer than she did even 70 years ago. Since 1950 the global expectancy of life at birth has risen from 46 years to 73 years, the world economy’s GDP has grown more than 15-fold to over 130 trillion international dollars a year, global per capita income has increased more than 5-fold to over 17,000 international dollars per year, and there are 5.3 billion more people today to enjoy that increase (world population today is 7.8 billion). It would seem we are living in the very best of times. But Nature is an asset. We are embedded in Nature. It is our home, and it provides us with a multitude of services we take for granted. So, even while we have enjoyed the fruits of economic growth, the demands we have made of Nature’s goods and services have for some decades exceeded her ability to supply them on a sustainable basis. One estimate suggests that we would need 1.6 Earths to satisfy our current demands on a sustainable basis. We do not have the extra 0.6 Earths. Because the difference between demand and sustainable supply is met by a diminution of Nature, the gap has been increasing, threatening our descendants’ lives. It would seem we are also living at the very worst of times.

One prominent reason for the increase in the gap between demand and sustainable supply is an absence of institutions for creating necessary incentives to economise on our use of Nature’s fundamental services. The high seas, for example, are used by us to enjoy cruises, transport goods, and harvest for fish. We use them as well as a sink for many of our waste products. And yet we are not charged for their use. Worse, governments subsidise the use of Nature to the extent of some 4 to 6 trillion US dollars annually, which is some 5 to 7 per cent of global GDP. In effect, we pay ourselves to eat into Nature.

“While humanity has prospered immensely in recent decades, the ways in which we have achieved such prosperity means that it has come at a devastating cost to Nature. Estimates of our total impact on Nature suggest that we would require 1.6 Earths to maintain the world’s current living standards.”

― The Economics of Biodiversity: The Dasgupta Review

Ecosystems as assets

The Review recognises the biosphere as a web of interconnected self-regenerative entities called ‘ecosystems’. Processes governing ecosystems are non-linear. Moreover, they differ among one another both in speed and spread, which is why even the decision to designate a patch of the environment as an ecosystem depends on the context - a hedgehog’s gut is as much an ecosystem as the woodland in which the hedgehog resides.

Individual actors in ecosystems include organisms that, among other activities, pollinate, decompose, filter, transport, redistribute, scavenge, and fix gases. Nearly all organisms that help to produce those services are hidden from view (a gram of soil may contain as many as 10 billion bacterial cells), which is why they are almost always missing from popular discourses on the environment. But their activities enable ecosystems to maintain a genetic library, preserve and regenerate soil, fix nitrogen and carbon, recycle nutrients, control floods, mitigate droughts, filter pollutants, assimilate waste, pollinate crops, operate the hydrological cycle and maintain the gaseous composition of the atmosphere. These are what ecologists call ‘regulating and maintenance services’. The processes that give rise to them are in large measure complementary to one another: degrading one severely can be expected to threaten the others. Biodiversity, by which is meant the diversity of life, is a characteristic of ecosystems. The Review builds on our increased understanding of the sense in which biodiversity contributes positively to ecosystem productivity. The economics of biodiversity is thus the economics of the entire biosphere. In addition to produced capital and human capital, the economics of the biodiversity includes what we may call ‘natural capital’.

Regulating and maintenance services provide the basis on which we draw upon Nature’s ‘provisioning goods’, such as food, timber, medicines, dyes, fibres, and fresh water, and enjoy ‘cultural services’, such as landscapes of tranquillity, beauty, even sacredness. The Review shows that there is a tension between humanity’s needs for these two classes of goods and services. Private companies are in large measure unable to capture the returns from investment in regulating and maintenance services. That’s because the services are in all too many cases ‘non-excludable’: companies cannot confine the benefits to those who pay for them. So, they invest mostly in those forms of natural capital that are direct inputs for provisioning services (farms, plantations, houses, manufactured goods, and transportation), whose products are excludable. That practice has eroded Nature’s regulating and maintenance services. Non-market institutions have been introduced to protect cultural services (state parks and Nature reserves). Non-excludability is a reason the economics of biodiversity pays particular attention to ‘externalities’, which are the unaccounted consequences for others of our actions.

Because the biosphere is a tangled web of ecosystems, the Review, unlike the economics of global climate change, does not offer sharp formulae for policy, such as a social price for biomass. It does not prescribe ‘biomass offsetting markets’. That’s because a unit of biomass in a particular location in one ecosystem (e.g. a tropical rainforest) has widely different roles to play from a unit of biomass in another (e.g. in a grassland). Differences arise because the processes governing ecosystems are entangled with one another. Their entanglement is the reason ecosystems harbour what may be called ‘natural externalities’. If biomass offsetting markets were introduced, brokers could profitably purchase units of biomass from ecologically productive places and offset them in ecologically unproductive places, making a profit. Further institutional mechanisms would then be needed to regulate such transactions. The Review speaks of ecosystems as the source of Nature’s supply of goods and services; it does not build the economics of biodiversity on units of biomass.

Image caption: Trevally Jacks stream over reef, Copyright iStock - Tammy616

The economics of biodiversity as a study in portfolio management

The Review is global in its reach in two senses: First, it is not restricted to a particular group of countries or cultures; it instead constructs an economic grammar that can be adopted anywhere. Secondly, it offers a vocabulary that speaks to institutions everywhere (government, charities, households, firms, banks, and financial companies). Anyone can adopt the common grammar and choose the vocabulary that meets their motivation and reach.

That the Review found it necessary to construct a common grammar for the economics of biodiversity is self-explanatory. Fires cannot be put out if fire fighters do not coordinate their tasks. If humanity is to face up to the emergency we have created by the enormous overshoot in the demands we have been making on the biosphere relative to its ability to meet them in a sustainable manner, there needs to be coordination among agencies. The Review therefore urges not only national governments and central banks, but also international organisations such as the World Bank, International Monetary Fund, and Food and Agriculture Organisation to include estimates of the ecological consequences of their policies before advocating them.

The Review studies Nature in relation to the many other assets we hold in our portfolios, such as the vehicles we use for transport, the homes in which we live and the machines and equipment that furnish our offices and factories. But like education and health, Nature is more than a mere economic good. So, we should think of assets as durable entities that not only have what economists call ‘use value’, but may also have intrinsic worth. Once we make that extension, the economics of biodiversity becomes a study in portfolio management.

That should be easy to understand, for we are all asset managers, pretty much all the time. Whether as farmers or fishermen, foresters or miners, households or companies, governments or communities, we manage the assets to which we have access in line with our motivations as best as we can. But because Nature is under-priced in our day-to-day life, the best each of us is able to achieve with our portfolios may nevertheless result in a massive collective failure to manage the global portfolio of all our assets. The gap between demand and supply, which I spoke of just now, can be likened to a crowd of people trying to keep balance on a hanging bridge and bringing it crashing down.

Image caption: Amazon rainforest understorey, rainforest tree with buttress roots, Copyright iStock - Atelopus

Biodiversity is the diversity of life. Just as diversity within a portfolio of financial assets reduces risk and uncertainty, diversity within a portfolio of natural assets increases Nature’s resilience in withstanding shocks. Today there are around 8 to 20 million (possibly more) kinds of organisms with cells in which the genetic material in the form of chromosomes that are contained within distinct cells (they are called eukaryotes). Of them, only about 2 million have been recognised and named. There are, in addition, an unknown and much larger number of prokaryotes, consisting of archaea and bacteria – our lack of knowledge is enormous. But biodiversity has several dimensions, including the diversity and abundance of living organisms, the genes they contain and the ecosystems in which they live.

One manifestation of the increasing gap between the demands we are making of the biosphere and the biosphere’s ability to supply them on a sustainable basis is species extinction. Current extinction rates of species in various orders are estimated to have risen to 100-1,000 times the average extinction rate over the past tens of millions of years (the ‘background rate’) of 0.1-1 per million species per year (expressed as E/MSY), and are continuing to rise. In absolute terms, 1,000 species are becoming extinct every year if 10 million is taken to be the number of species and 100 E/MSY the current extinction rate. At the global level, climate change and COVID-19 are striking expressions of Nature’s loss of resilience. But many small, village communities in the world’s poorest regions have experienced loss of resilience in their local systems.

“Biodiversity is declining faster than at any time in human history. Current extinction rates of species in various orders are estimated to have risen to 100-1,000 times the average extinction rate over the past tens of millions of years (the ‘background rate’) of 0.1-1 per million species per year (expressed as E/MSY), and are continuing to rise. Such declines are undermining Nature’s productivity, resilience and adaptability, and are in turn fuelling extreme risk and uncertainty for our economies and well-being.”

― The Economics of Biodiversity: The Dasgupta Review

Inclusive wealth and sustainable development

The 1987 Report of the Brundtland Commission defined ‘sustainable development’ as "... development that meets the needs of the present without compromising the ability of future generations to meet their own needs". The requirement is that, relative to their respective demographic bases, each generation should bequeath to its successor at least as large a productive base as it had inherited from its predecessor. If it were to do so, economic possibilities facing the successor would be no worse than those the generation faced when inheriting the productive base from its predecessor.

The Review demonstrates that in order to judge whether the path of economic development we choose to follow is sustainable, nations need to adopt a system of economic accounts that records an inclusive measure of their wealth. The qualifier ‘inclusive’ says that wealth includes Nature as an asset. Inclusive wealth is the social value of an economy’s produced capital, human capital, and natural capital. The contemporary practice of using gross domestic product, or GDP, to judge economic performance is based on a faulty application of economics. GDP is a flow – so many market dollars of output per year. In contrast to inclusive wealth, which is a stock (it is a social worth of the economy’s entire portfolio of assets). Relatedly GDP does not include the depreciation of assets, for example the degradation of the natural environment.

As a measure of economic activity, GDP is indispensable in short run macroeconomic analysis and management. But it is wholly unsuitable for appraising investment projects and identifying sustainable development. Nor was GDP intended by economists who fashioned it to be so used for those purposes. An economy could record a high rate of growth of GDP by depreciating its assets. But one would not know that from the national statistics.

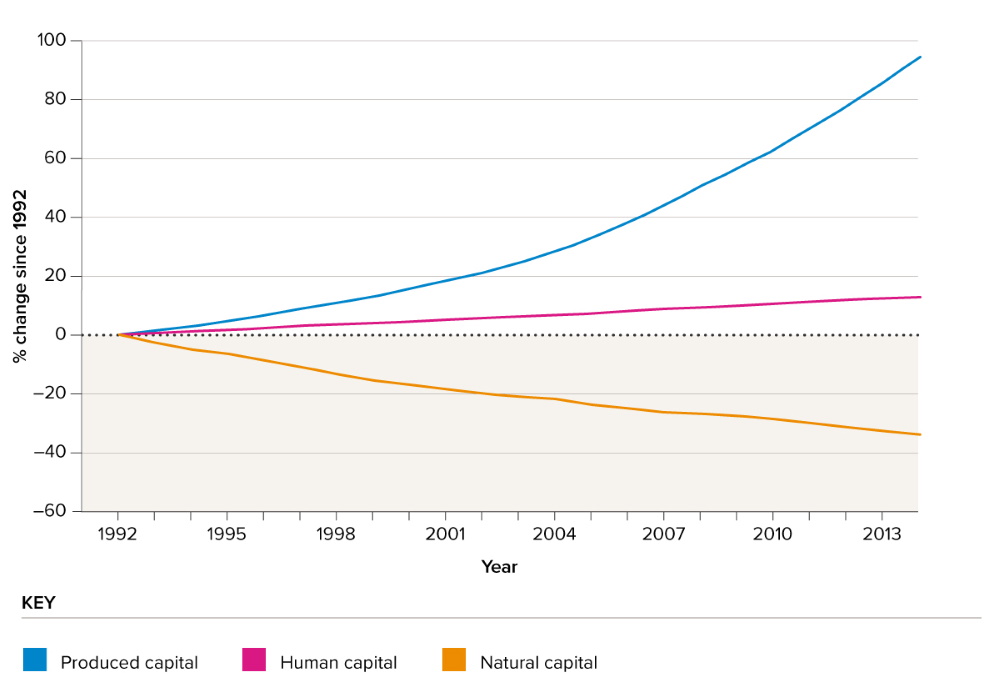

The Review finds that in recent decades eroding natural capital, or Nature (I am using the terms interchangeably), has been precisely the means the world economy has deployed for enjoying what is routinely celebrated as economic growth. Acknowledgement that by economic progress we should mean growth in inclusive wealth brings the Review back full circle to where it begins, 500 pages before, that is. Which is that, just as a private investor manages their portfolio with an eye on its market value, the citizen investor will want to appraise the portfolio of global assets with an eye on their social worth. Maximisation of inclusive wealth unites economic reasoning in all its forms.

“Collectively, however, we have failed to manage our global portfolio of assets sustainably. Estimates show that between 1992 and 2014, produced capital per person doubled, and human capital per person increased by about 13% globally; but the stock of natural capital per person declined by nearly 40%. Accumulating produced and human capital at the expense of natural capital is what economic growth and development has come to mean for many people.”

― The Economics of Biodiversity: The Dasgupta Review

Source: S. Managi and P. Kumar, The Inclusive Wealth Report 2018 (London: Routledge)

The Review makes use of this unification to develop the idea of sustainable development. It constructs a grammar for understanding what we take from Nature; how we transform what we take from it and return to it; why and how in recent decades we have disrupted Nature’s processes to the detriment of our own and our descendants’ lives; and what we can do to change direction.

Natural Capital, the Impact Inequality, and Mutual Causality

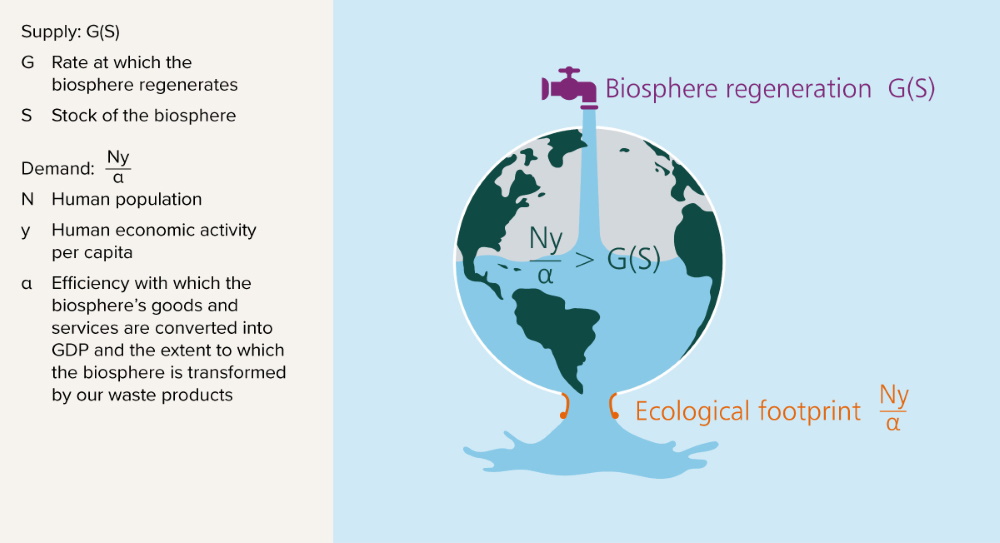

It is today common to call the demand that we make of the biosphere’s goods and services our ‘ecological footprint’. The Review also calls it our ‘impact’, which is why the Review calls the gap between humanity’s demand and the ability of the biosphere to meet that demand on a sustainable basis, the Impact Inequality. The analogy I drew previously between the Impact Inequality and fighting fires tells us that before all else we need to close the gap.

The Review first decomposes the demand by taking global GDP to be a measure of human activities. To formalise, let N be global population and y per capita global GDP. That means global GDP is Ny. As GDP is the market value of the final goods and services produced in a year, we need to convert it to units of the biosphere’s goods and services. So let α be a numerical measure of the efficiency with which the biosphere’s supply of goods and services are transformed into marketable products. It follows that Ny/α is the global demand for the biosphere’s flow of goods and services.

Turning to the supply side, assume for simplicity that the biosphere’s supply of goods and services can be aggregated into a numerical measure, labelled by G. (If the aggregation, which would be a weighted sum of Nature’s goods and services, reads far fetched, the supply of each service should be read separately.) The biosphere is our global natural capital. Let S denote that stock, measured in terms of the biosphere’s features such as biodiversity. (We should again imagine that S is a weighted sum of stocks of ecosystems. The appropriate weights are known as ‘accounting prices’, and reflect the social worth of the stocks.) Now G is a function of S, the bigger is S, the larger is G, at least in the biosphere that prevails today. We may then write G = G(S). Because the biosphere is finite, G cannot exceed a finite limit. Armed with this notation, the Impact Inequality can be expressed as:

Ny/α > G(S)

N, y, and α are not independent of one another. Policies that affect y may cause households to alter their reproductive goals, implying that future values of N would be affected; policies that affect α would be expected to influence y; and so on. More generally, mono-causal explanations are to be avoided in the social and ecological sciences. The Impact Inequality contains five variables: N, y, α, G, S. Each is a function of time, and each can be influenced by policy. Of them, N, α, and S are stocks, while y and G are flows. If the Impact Inequality is to be closed, we have to reduce Ny/α or find ways to increase G(S), or both. The variable α is a reflection of the technologies that are in use and the institutions that are in play. In view of the prevailing distortions in the world economy, we can surely improve both the technologies we deploy and the institutions we fashion. But no amount of progress in the two can raise α to infinity, for to imagine that it could be so raised would be to imagine that we can in time free ourselves of Nature. That, as the Impact Inequality shows, means in turn that perpetual growth in global GDP, Ny, is an impossibility.

Per capita income y can be affected even in the short run, as can S (it doesn’t take much time today to decapitate a forest), and the trajectory of N has been known to alter sharply under rapidly changing fertility behaviour and improved hygiene and medical facilities. Investment in family planning and reproductive health has proved to be remarkably effective in ushering fertility transitions (Bangladesh in recent years; Taiwan and South Korea in the post War decades). It can take time to increase S (wetlands cannot be restored overnight). But it can nevertheless be socially profitable to do so, because, in the face of a growing gap in the Impact Inequality, the social worth of S relative to produced capital will increase over time. And changes in institutions or technology (α) have an impact on y, N, and G with varied gestation lags.

The Review presents a dynamic socio-ecological model in which all five are endogenous variables. Thus, each influences the others over time and is in turn influenced by the others. The model shows that mutual causation is the rule in socio-ecological systems. It is thus as wrong to insist that high consumption (read y) in industrial countries is the underlying cause of biodiversity loss as it is to claim that large population (N) is the underlying cause.

Only a quantitative model can unearth the mutual influence among economic variables. Policies that are directed at y can be expected to have an effect on future N as households adjust their fertility targets. Likewise, policies directed at influencing fertility behaviour (future N) can be expected to have an effect on y. And it’s not hard to see why policies that bring about institutional changes and new technology (α) will have an effect on all the variables, even future values of α. The Review presents a socio-ecological model that demonstrates such mutual influence. And yet, in public discourses on the environment the practice is all too often to avoid mentioning policies that would affect future values of N; the focus is instead on y, α, and the biosphere’s ability to produce goods and services as expressed in G. The Review argues that there are no reasons for awarding N a different normative status from the others.

As I noted earlier, by one (inevitably very crude) estimate, the ratio of demand to supply (ie Ny/α G(S)) is today approximately 1.6. If ‘sustainable development’ has any meaning, it should as a minimum be read as a pattern of development in which the Impact Inequality is converted into an equality. Which is why it is a puzzle that designers of the UN’s 17 Sustainable Development Goals – to be reached by year 2030 – didn’t ask whether the goals, taken together, are sustainable. Estimates reported in the Review show that meeting them on a sustainable basis would require transformative changes in global institutions.

The need for transformative changes

What then should be done to direct humanity to a sustainable mode of living? Reducing the gap between what we demand of Nature and what Nature is able to supply on a sustainable basis requires, as noted previously, that we reduce our demand (Ny/α) and help to increase Nature’s supply (G(S)). To achieve that will require measured, but transformative, change. For the task is to so change individual incentives that they direct the choice of our actions to align with actions that promote the common good. The change will have to be underpinned by levels of ambition, co-ordination and political zeal akin to, but even greater than, those of the Marshall Plan. It will require changes in our institutions and practices at not only the national level but also at the transnational level and at the level of communities and civil society. And closer still, at the level of the individual person.

Investment in Nature is a route to increasing Nature’s supply. It can take many forms. Technological innovations and sustainable food production systems can decrease the sector’s contribution to climate change and change in the way land is used. Expanding and improving the management of protected areas has an essential role to play. Nature-based solutions to protect and restore have been found not only to generate employment, but help also to reduce the risks companies face in the functioning of their supply chains.

“There is evidence that Nature-based solutions can provide large social benefits by reducing coastal risks due to climate change and development. In the Gulf of Mexico, USA, where such risks are increasing, the cost-effectiveness of adaptation measures were compared, including oyster reef or wetland restoration, grey infrastructure, and policy measures such as home elevation. Flooding costs were predicted to be US$134–176.6 billion in 2030, with annual costs expected to double by 2050 due to increasing risks. The Nature-based solutions compared favourably with engineered solutions; average benefit-cost ratios for Nature-based solutions were above 3.5. Cost-effective coastal adaptation measures could prevent US$57–101 billion in losses; Nature-based solutions could avert more than US$50 billion of these costs.”

― The Economics of Biodiversity: The Dasgupta Review

The Review points to numerous examples where this is happening. As part of fiscal stimulus packages in the wake of COVID-19, investment in natural capital has the potential for quick returns. Natural capital forms the bulk of wealth in low-income countries and those on low incomes tend to rely more directly on Nature. Conserving and restoring our natural assets also contributes to alleviating poverty. At the international level we now need supranational institutions to monitor and administer the global commons such as the high seas. The rents that could be collected for their use could, in turn, be used to pay for the protection of global public goods that are housed within national jurisdictions such as tropical rainforests and peatlands. And we would save resources if governments were able to eliminate the massive subsidy they offer people to eat into Nature.

Processes governing ecosystems are non-linear, which means ecosystems harbour thresholds, crossing which would radically transform their ability to supply goods and services – for the worse. Which is why it is typically less costly to conserve Nature than to restore it once it is damaged or degraded.

The location of ecosystem thresholds is always uncertain. Moreover, information on technology and the state of ecosystems is not commonly held: a regulator would typically know less about local ecosystems than these who reside in them. Taken together, these features of the human economy tell us that there is a strong economic rationale for quantity restrictions over pricing mechanisms. Moreover, insistence by consumers that firms disclose conditions along their entire supply chain would ultimately reduce the risks those firms face in their profits. Disclosure serves as a substitute for incompleteness of the prices for risk.

The total demand we make of Nature’s goods and services is affected not only by our average living standards (y) but also by our numbers (N). Influencing the two will also involve changes in institution design and practices. The national level offers a number of avenues for reducing our demand. Increase in community/civil society partnerships with government, so as to help reduce consumption waste in rich countries, and investing in family planning and reproductive health services in the world’s poorest countries, should be a priority. In the UK, more than a third of our food is wasted from source to sink. And more than 220 million women in the world’s poorest countries have expressed an unmet need for modern family planning services. To put it bluntly, food in the aggregate is too cheap in rich societies, and the EU budget of less than 1% of development aid directed at family planning is thoughtless. Fortunately, contrary to contemporary economic thinking, we humans are not entirely egocentric. We are also socially embedded. The costs of change, if they are shared, are likely to be a lot less than if they were perceived to be incurred individually. Our experience with collective lockdown in response to COVID-19 illustrates that.

But Nature has three properties that make the economics of biodiversity markedly different from the economics that informs our intuitions about the character of produced capital. Many of the processes that shape our natural world are mobile, silent and invisible. The soils are a seat of a bewildering number of processes with all three attributes. Taken together, the attributes are the reason it is not possible to trace very many of the harms inflicted on Nature and, by extension, on humanity, to those who are responsible. Just who is responsible for a particular harm is often neither observable nor verifiable. No social mechanism can meet this problem in its entirety. meaning that no institution can be devised to enforce socially responsible conduct.

It would seem then that, ultimately, we each have to serve as judge and jury for our own actions and that cannot happen unless we develop an affection for Nature and its processes. And that affection can flourish only if we each develop an appreciation of Nature’s workings. The Review ends with a plea that our education systems should introduce Nature studies from the earlier stages of our lives and revisit them in the years we spend in secondary and tertiary education. The conclusion we should draw from this is unmistakeable. If we care about our common future, and the common future of our descendants, we should all, in part, be naturalists.